high iv stocks reddit

Here is a list of high IV stocks data from July 2nd using this criteria. IV Percentile Study filter Between 49-100.

Plant Cell Structure Of A Vegetal Cell Ad Cell Plant Vegetal Structure Ad Plant Cell Plant Cell Structure Cell Wall

I caught SPRT on Friday when IV was near 500.

. IV rank or implied volatility rank is a metric used to identify a securitys implied volatility compared to its Implied Volatility history. I chose a low strike of 15 and premiums still looked attractive to me. When implied volatility is high we like to collect creditsell premium and hope for a contraction in volatility.

The VolDex Implied Volatility Indexes generally refers to. Bausch health companies inc com. Ive done well out of theta in general.

High IV or Implied Volatility affects the prices of options and can cause them to swing more than even the underlying stock. Implied Volatility refers to a one standard deviation move a stock may have within a year. From early January BBBY stock went from 18 to a high.

If a company has cut their dividend in the last 12 months. The lower the IV is the less we can expect to. The Option IV Rank and IV Percentile page shows equity options with the highest daily volume along with their at-the-money ATM average IV Rank and IV Percentiles.

Cassava sciences inc com. If assigned my net cost basis would be 1255 which seemed attractive to me. Highlights heightened IV strikes which may be covered call cash secured put or spread candidates to take advantage of inflated option premiums.

For this reason we always sell implied volatility in order to give. Typically we color-code these numbers by showing them in a red color. A stock with a high IV is expected to jump in price more than a stock with a lower IV over the.

Arquit quantum inc com. You should not look just at premiums. Please note that the listed annual payout and dividend yield is based on the previous 12 months of dividend payments.

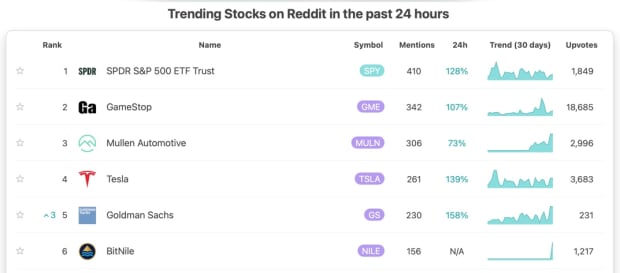

High Implied Volatility Call Options 30062022. Current implied volatility 100. Among the stocks to buy for the Reddit community Bed Bath Beyond hasnt had a stratospheric surge.

Nov 19 31 strike puts still offer solid premium and provide cushion for over 20 decline from the current share price. Thu Apr 21st 2022. IV determines which options are currently expensive expecting big moves and which are not.

High Implied Volatility Call Options 26052022. You should not write calls on stocks that you would be uncomfortable owning. Digital world acquisition corp com.

High IV Low IV. Risk management should be a key part of the strategy. Iv rank iv percentile top 20 on wsb.

It highlights Stocks ETFs and Indices with high overall callput volume along with their at-the-money Average IV Rank and IV Percentile. High IV strategies are trades that we use most commonly in high volatility environments. While the setup above does not contain an Implied Volatility IV filter all the stocks found by the scan happened to had an ImpVolatility higher.

With the 10-year US. But the gain has still been notable. High IV options trading list.

Anyone with experience selling puts on super high IV stocks. Iv rank iv percentile top 20 on wsb. SwaggyStocks brings you FD Rankr a way to quickly rank your top stocks by option Implied Volatility IV and see how earnings affects IV crush of an option.

A measure of option cost and implied volatility. The risk of poor earnings is always there but the amount of premium to collect will off-set some losses should the stock tank. If XYZ stock is trading at 100.

At least 1. In contrast the implied. First majestic silver corp com.

I really appreciate your feedback and comments to improve the list. Below you will find a list of companies that offer dividend yields of 4 or higher that trade on the New York Stock Exchange and the NASDAQ. Historically implied volatility has outperformed realized implied volatility in the markets.

Just like it sounds implied volatility represents how much the market anticipates that a stock will move or be volatile. Also you should not get into concentrated positions. Market capitalisation 1 billion.

Highest Implied Volatility Options. Treasury note yielding 25 buying a stock with a yield north of 4 looks like a no-brainer for an income investor. What is considered to be a high Implied Volatility Percent Rank.

If the IV30 Rank is above 70 that would be considered elevated. Implied volatility in stocks is the perceived price movement derived from the options market of that particular stock. If you are a risk-taker stock hovering around 1 tends to have a pretty high IV.

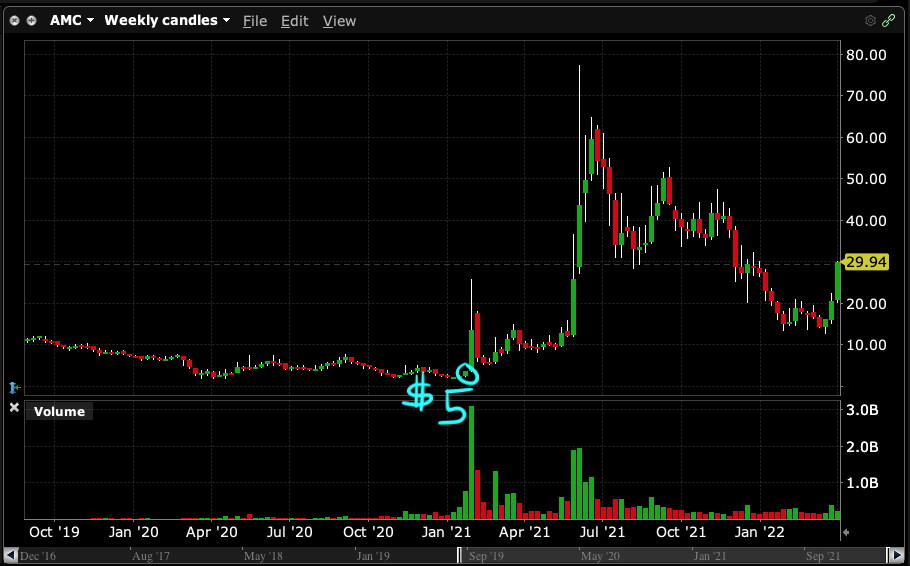

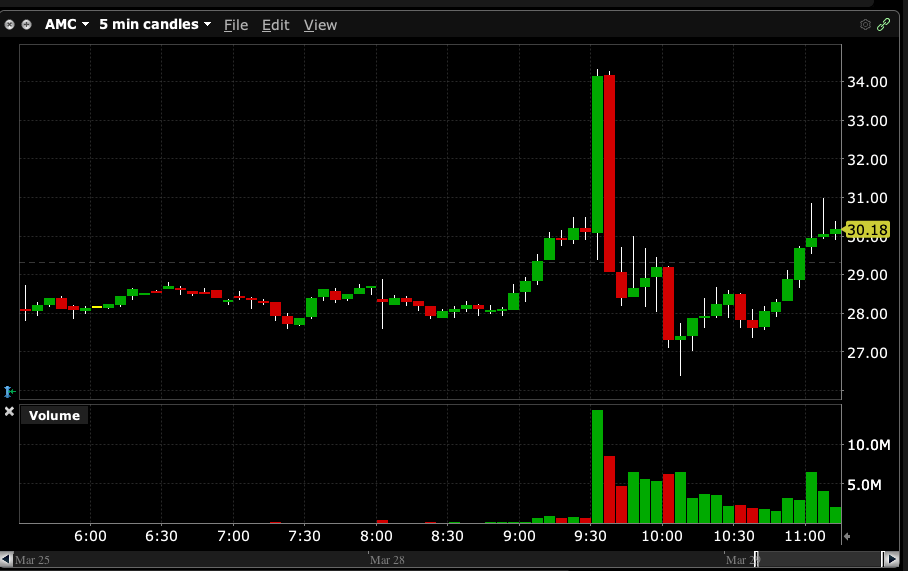

A high implied volatility environment will result in a wider one standard deviation SD than a low IV environment. Although the AMC share price has been in limbo for some months now IV is still very high 113. GRWG -2200 bought shares at 36 SOFI -1600 shares at 18 AMD - 2000 shares at 147 CRSR -1400 shares at 36 Strategically Ive bee railed whenever I go long on shares.

VolDex Implied Volatility Indexes. The stocks volatility for the past 20 days and the past 1 year is based on the stocks actual price movements. A green implied volatility means it is increasing compared to.

If a stock is 100 with an IV of 50 we can expect to see the stock price move between 50-150. If anyone wants to give me their strategy then fine. I think elevated IV should be just one criteria for choosing stocks to write covered calls.

Call Options Screener with High Implied Volatility - Indian Stocks. High Implied Volatility Strategies. Currently 10242020 there are 12 stocks that match the criteria.

Implied volatility is presented on a one standard deviation annual basis. Stock price 5.

Amc Reddit Fans Celebrating Gains For Now Nyse Amc Seeking Alpha

Reddit The Front Page Of The Internet Flood War Hearts Of Iron Iv

Gme Amc Are Broken And Unmeasurable This Goes For Both Trading Options And The Stock Itself R Options

Cranial Nerves Tricks Mnemonics Anatomiya I Fiziologiya Nevrologiya Medicinskie Uchilisha

Contextlogic Wish Is A Quintessential Meme Stock With An Eroding Path To Profitability A Material Short Interest A Pending Class Action Lawsuit And Soaring Popularity On Reddit

High Redemption Spacs Are On A Wild Reddit Meme Ride Boardroom Alpha

I Analyzed The Last 3 Decades Of Stock Market Returns To Determine If It Makes Sense To Time The Market Here Are The Results R Options

Ultimate Guide To Selling Options Profitably Part 4 Finding A Edge And Building A Trading Strategy R Options

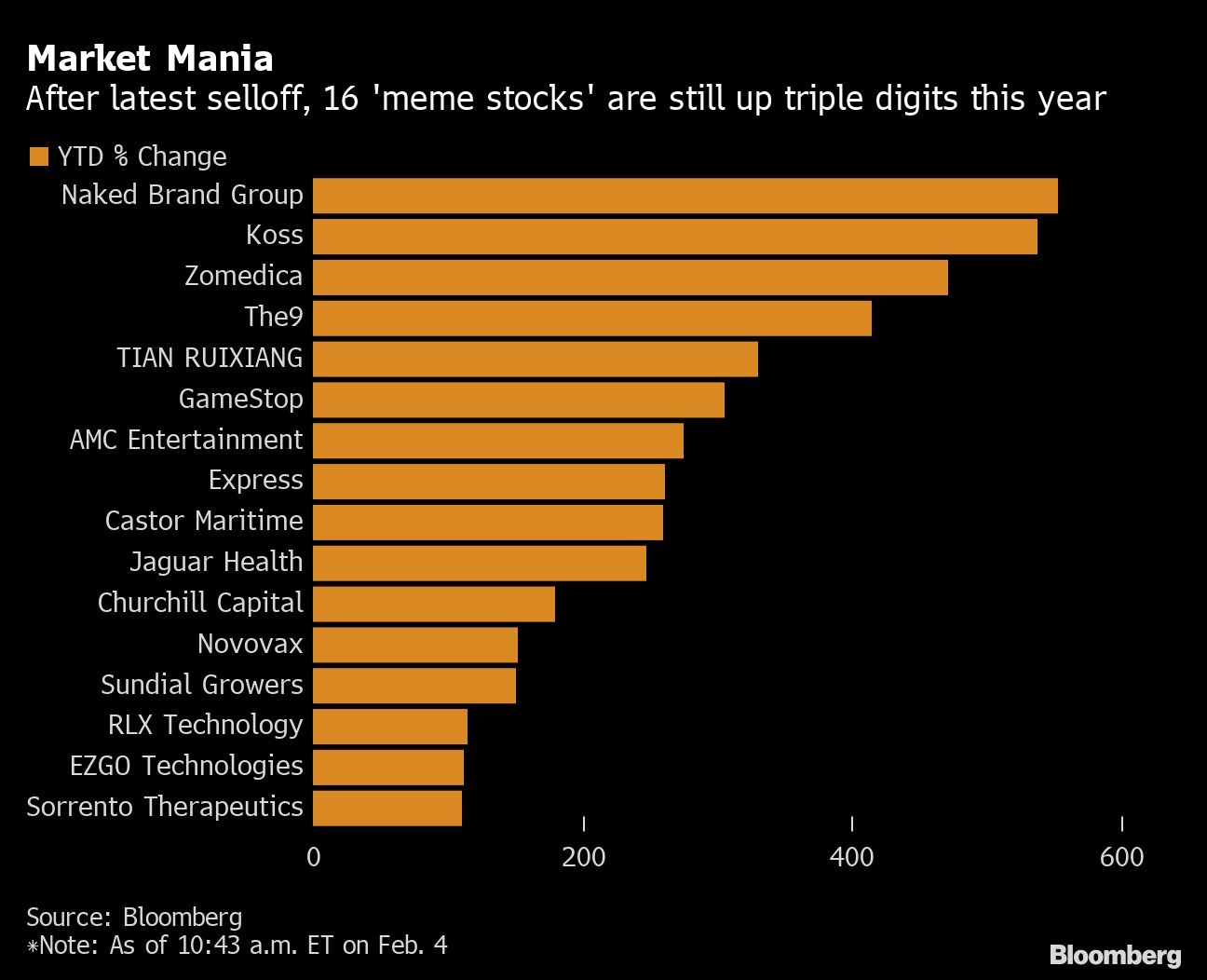

There Are Still 16 Meme Stocks With At Least 100 Gains In 2021 Bnn Bloomberg

Gamestop Stock Up Strongly It Could Be Heading To The Moon Meme Stock Maven

Reddit Traders Put 345m Into Amc But Meme Stock Mania Has Peaked

Stock Goes Lower Puts Go Down R Options

La La Land 2016 1600 X 2263 Movieposterporn La La Land Pornographic Film High Quality Images

Comparison Between R And L 24 105 What Are You Choosing Camera De Filmagem Equipamento Fotografico Cameras Canon

Amc Reddit Fans Celebrating Gains For Now Nyse Amc Seeking Alpha

Implied Volatility The Rubber Band That Barely Holds It All Together R Options

Sadp Sneakers Addict Daily Pics 10 04 2013 Page 2 Sur 4 Wave Chaussure Sport Homme Basket Homme Chaussures De Sport Mode

Options Explained A Quick Beginners Guide R Wallstreetbets

Reddit Battlemaps Spaceport Traveller Rpg Star Wars Rpg Game Master